2024 Proxy and 10-K Season:

Key Considerations to Get Out Ahead of the New Rules

November 9, 2023

It’s coming up on 10-K/Proxy Season again. New rules adopted by the SEC this year require (i) disclosure of cybersecurity preparedness and cybersecurity-related incidents and (ii) companies to adopt (and file as exhibits) clawback policies to recover incentive-based executive compensation in the event of financial restatements. Also, as we go into the second year since the SEC adopted the Pay versus Performance Rule, companies must continue to refine their disclosures on how executive compensation aligns with the company’s financial performance. Finally, best practices continue to evolve on ESG and Human Capital disclosures.

Below, we provide a summary of the new rules and evolving disclosures, and identify practical considerations to help companies stay ahead of the curve as they navigate and adapt to these changes.

Cybersecurity Disclosure

Beginning December 18, 2023, all public companies must:

- Report material cybersecurity incidents on Form 8-K (smaller reporting companies may take advantage of an extension until September 23, 2024).

- Provide annual disclosure in Form 10-K describing management’s role in assessing and managing cybersecurity risks, and the board of directors’ role in oversight of those risks.

What to Do Now

- Assess and test existing procedures for responding to cybersecurity incidents.

- Consider hiring an outside firm now to provide an evaluation of the company’s existing procedures and implement any changes in time to include the analysis and changes in your Annual Report on Form 10-K.

- Consider whether to form a cyber committee of the board or senior management to oversee cybersecurity threats, and have that in place in time to include it on the 10-K.

Clawback Rules

Beginning December 1, 2023, public companies must:

- Adopt and include clawback policies as exhibits to their Annual Reports on Form 10-K.

- Provide accompanying disclosures that identify incentive-based compensation subject to recovery and explain the process for recovery of all or a portion of that incentive-based compensation.

- Describe how clawback policies were implemented during or after the last completed fiscal year.

- Indicate via checkboxes on the cover page of the 10-K if the financial statements reflect a correction to previously issued financial statements and whether any corrections are restatements requiring a recovery analysis of incentive-based compensation under the clawback policies.

What to Do Now

- Adopt a clawback policy before the December 1 deadline.

- Review and, if necessary, revise board committee charters and other board policies to ensure that the company has meaningful, workable procedures to implement the recovery process.

- If the company is NYSE listed, confirm (via a Listing Manager) either timely adoption of the policy or identify any applicable exemption.

- Review existing internal controls over financial reporting to confirm they are effective.

- Review existing employment agreements and other compensatory agreements to determine what changes are required in light of the new rules.

Pay versus Performance

The Pay versus Performance Rule, which was adopted last year, requires companies to demonstrate how executives’ pay aligns with the company’s financial performance.

For the 2024 proxy season, companies will need to:

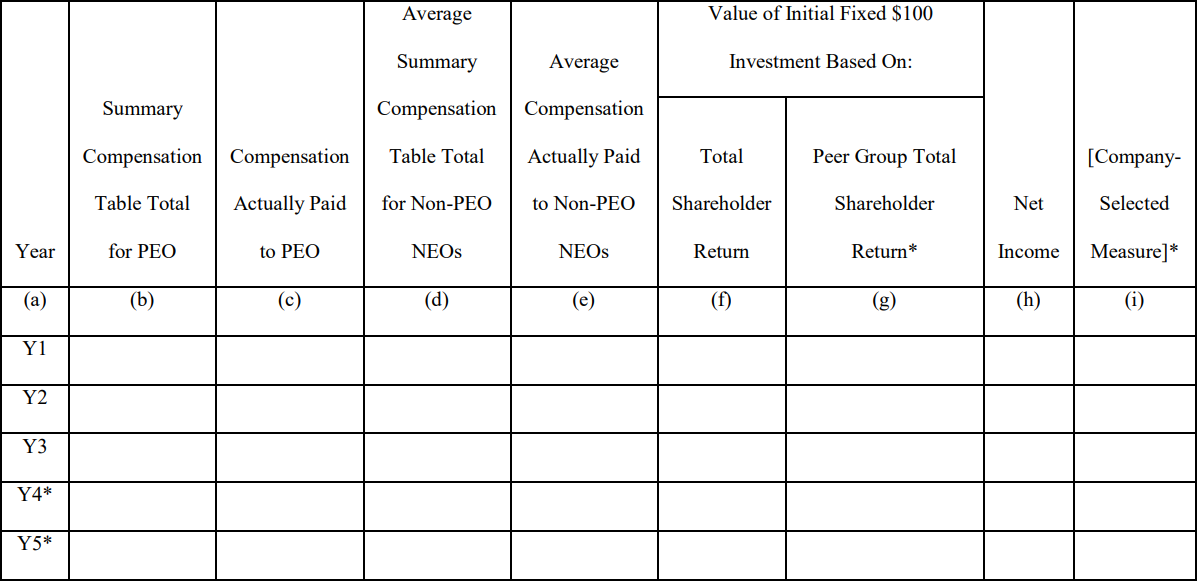

- Disclose the compensation information in the following tabular format:

Note: Adapted from Final rules: Listing Standards for Recovery of Erroneously Awarded Compensation, Release No. 33-11126 (Oct. 26, 2022) - Form and tag each value in the table and pay vs. performance disclosure using Inline XBRL (Small Reporting Companies (SCRs) are not yet required to use Inline XBRL but should prepare for this upcoming requirement).

- Include a narrative or graphical disclosure addressing comparability to total shareholder return (TSR), net income, and a company-selected financial metric.

- Report four years of data (three years for SRCs).

What to Do Now

- Gather data on executive compensation and financial performance of the company. Evaluate the existing metrics and benchmarks used to measure performance against pay.

- Conduct internal reviews to ensure that the company’s executive compensation programs align with the Pay versus Performance Rule.

- Compare the company’s executive compensation packages with industry peers and competitors to gain insights that support the company’s argument for reasonable compensation.

- Summarize the company’s performance measures and why they are relevant to its industry and unique circumstances to make it easy for shareholders to understand the connection between pay and performance.

Environmental, Social, and Governance (ESG)

Adopting ESG principles into strategy, risk management, human capital initiatives, and governance has become a business imperative for many companies, though we do acknowledge some emerging backlash and resistance in legislative and other circles. Nonetheless, this shift has been driven by growing support for ESG shareholder proposals and increased demand for ESG reporting from shareholders. Today’s shareholders seek a deeper understanding of how companies are advancing profitability and risk management from a broader societal context and are increasingly scrutinizing companies’ ESG performance. As companies prepare for the 2024 proxy season, they should adopt or refine their ESG principles in a way that sets a tone that resonates with shareholders.

What to Do Now

- Assess existing ESG initiatives to better understand how these principles are, if at all, already integrated into the company’s business operations and culture.

- Revisit policies, strategies, and governance structures to ensure these are current and remain relevant for accurate reporting in the annual report.

- Develop scenarios that illustrate how different ESG strategies and outcomes can impact the company’s long-term value and profitability to prepare for questions and discussions during the proxy season.

- Benchmark the company’s ESG performance against industry peers and best practices. Identify areas where the company can learn from others and improve your ESG initiatives.

- Get familiar with global ESG standards and reporting frameworks, such as the Global Reporting Initiative and Sustainability Accounting Standards Board

Human Capital Management

Recent amendments to Regulation S-K have introduced a reporting requirement on human capital resources in the business section of the 10-K. These amendments require a more detailed discussion on human capital measures and objectives that form part of the company’s strategic management and core operations.

What to Do Now

- Start gathering comprehensive data on the company’s human capital resources, including employee numbers and the relevant metrics and objectives associated with strategic management.

- Evaluate how the human capital measures and objectives align with the company’s strategic goals. Review and refine these objectives to ensure they are well integrated into the company’s overall business strategy.

- Develop scenarios that illustrate how changes in human capital measures and objectives can impact the company’s strategic management.

- Initiate conversations with stakeholders, including employees and shareholders, to understand their expectations and concerns regarding human capital management. Incorporate their feedback and address potential issues in your reporting.

Board Diversity

The scope of proxy statement disclosure concerning diversity, particularly in the context of Item 401 of Regulation S-K related to director qualifications, has expanded significantly and continues to evolve as we enter the new year. Although 2023 marked a decline in the number of shareholder proposals related to diversity, equity, and inclusion (“DEI”), institutional investors and proxy advisory firms remain unwavering in their commitment to prioritizing DEI considerations, particularly in the context of board diversity. By way of example, in its 2023 Proxy Voting and Engagement Guidelines, State Street Global Advisors informed companies that it may withhold or vote against the chair of a nominating committee if a company has inadequate diversity disclosures on board skills or in the case of S&P 500 companies that does not have at least one director from an underrepresented racial/ethnic community on their board.

What to Do Now

- Evaluate the company’s current diversity disclosure practices in previous Form 10-K filings and proxy statements. Identify areas where the company can enhance transparency and information related to diversity.

- Integrate diversity-related questions into the company’s director and officer questionnaires to collect information necessary for reporting and compliance.

- Review and, if necessary, revise board nomination and recruitment practices.

- Develop scenarios that illustrate how changes in board diversity can impact corporate governance and decision-making to prepare for discussions during the proxy season.

- Consider forming advisory committees focused on diversity and inclusion. These committees can provide guidance and recommendations to the board on diversity-related matters.

Conclusion

Compliance with the new disclosure requirements demands careful planning and thorough preparation. Companies may want to take proactive measures to stay ahead of the curve and prepare proxy and information statements earlier than usual.

Companies may also want to take initiative in shaping their own narrative by approaching their reporting process with an understanding that proxy statements and annual reports are no longer just about numbers and mere compliance for reporting requirements but are transcending their conventional role and evolving into a powerful tool for communication and strategic messaging to shareholders. To delve beyond the checkboxes of regulatory requirements, companies may want to explore how to use reporting to craft a compelling narrative on their vision and value in a way that resonates with and meets the evolving demands of shareholders.

To discuss how to prepare for the 2024 proxy and 10-K season contact your CFDB lawyer or:

Geoffrey R. Morgan

Partner

gmorgan@crokefairchild.com

414.588.2948

Camila Di Mauri

Associate

cdimauri@crokefairchild.com

773.354.7364